Introduction

The full-scale Russian invasion caused the largest housing crisis in Ukraine’s history since gaining independence in 1991. According to estimates by international organizations, as of October 2024, around 3.5 million people are de facto internally displaced, and 4.5 million people have returned to their usual places of residence. Housing is one of the sectors most negatively affected by the war. As of the end of 2023, at least 2 million homes had been destroyed or damaged, accounting for approximately 10% of the total housing stock.

Housing and housing policy are among the key topics addressed by the Cedos Think Tank. We advocate for the development of a housing policy that can comprehensively respond to diverse housing needs. We believe that social housing in its broad sense—that is, housing for long-term affordable rent—can become one of the tools to overcome the housing crisis. To advocate for the necessity of developing social housing in Ukraine, we conduct research, collect data on the population’s housing conditions and changes in the housing sector.

The goal of this survey was to examine housing conditions, particularly housing affordability, the structure of ownership forms in the housing sector, and the population’s vulnerability to the hypothetical loss of housing. To assess changes in the housing sector and maintain continuity in the research process, we repeated some of the questions from 2022 in this year’s study.

Methodology

The field stage of the survey was commissioned by the Cedos Think Tank and conducted by the Kyiv International Institute of Sociology from September 25 to October 8, 2024. The survey was carried out using computer-assisted telephone interviews (CATI) based on a random sample of cell phone numbers (with random generation of phone numbers and subsequent statistical weighting). A total of 2,019 respondents residing in all regions of Ukraine (except the Autonomous Republic of Crimea) were surveyed. The interviews were conducted with individuals aged 18 and older who, at the time of the survey, lived in territory under the control of the Ukrainian government. The sample did not include residents of temporarily occupied territories of Ukraine or people who moved abroad after February 24, 2022.

The distribution of the entire adult population by macro-regions and types of settlements was determined based on data from the Central Election Commission following the 2019 parliamentary elections (by the number of registered voters). The gender and age structure was determined using data from the State Statistics Service of Ukraine as of January 1, 2021. A weighting procedure was applied to the obtained data.

The statistical sampling error (with a probability of 0.95 and a design effect of 1.1) does not exceed:

- 2.4% for indicators close to 50%,

- 2.1% for indicators close to 25 or 75%,

- 1.5% for indicators close to 10 or 90%,

- 1.1% for indicators close to 5 or 95%,

- 0.5% for indicators close to 1 or 99%.

Due to the unavailability of statistical data on the population structure of Ukraine after the Russian invasion, the study’s conclusions may contain inaccuracies when extrapolated to the current population of Ukraine.

A total of 2,019 respondents participated in the survey. The socio-demographic characteristics of the respondents are as follows:

- 45% of the respondents are men, 55% are women.

- 36% of the respondents belong to the 18–39 age group, 35% belong to the 40–59 age group, and 29% belong to the age group of 60 and older.

- The highest number of the respondents reside in the Western and Central macro-regions (29% each). 24% of the respondents live in the Southern macro-region, while 9% live in the Eastern macro-region and 9% in Kyiv.

- 40% of the respondents live in regional centers, 22% live in other cities, and 38% in rural towns and villages.

When analyzing the responses to the questions, the options “Difficult to answer” and “Refusal to answer” were excluded from the analysis as omitted values.

Survey results

Structure of forms of ownership in the residential sector

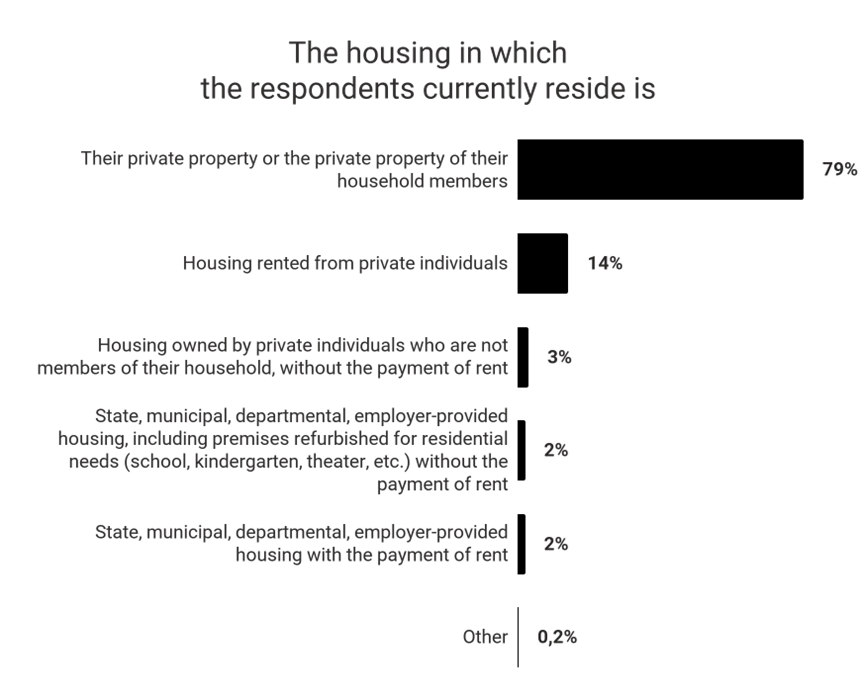

We asked respondents to indicate the type of housing they currently live in. The majority (79%) of respondents answered that they live in housing that is their private property or the private property of members of their household (hereafter referred to as “owned housing”). A significantly smaller share of respondents live in other types of housing. Specifically, 14% of respondents live in housing rented from private individuals (hereafter referred to as “rented housing”), 3% live in housing owned by private individuals without paying rent, 2% live in state, municipal, departmental, or employer-provided housing without paying rent, and another 2% live in these types of housing with rent payment.

Question: “The housing you currently live in is…?”. Number of respondents=2015

In one of the previous studies, we also asked respondents to answer this question. As of October 2022, 76% of respondents lived in owned housing, while 16% lived in rented housing.

Compared to 2021, the structure of housing ownership has changed: the share of renters has increased, while the share of owners has decreased. In 2022, the State Statistics Service published a statistical collection on the socio-demographic characteristics of Ukrainian households. This collection is based on the results of a survey conducted in November 2021 and contains information about the housing ownership structure at that time. According to this data, in 2021, 95% of respondents in Ukraine lived in owned housing, 5% in housing rented from private individuals, 0.3% in state housing, and 0.2% in departmental housing. Meanwhile, the results of our study indicate that by 2024, these shares are lower for owned housing (79%) and higher for rented housing (14%).

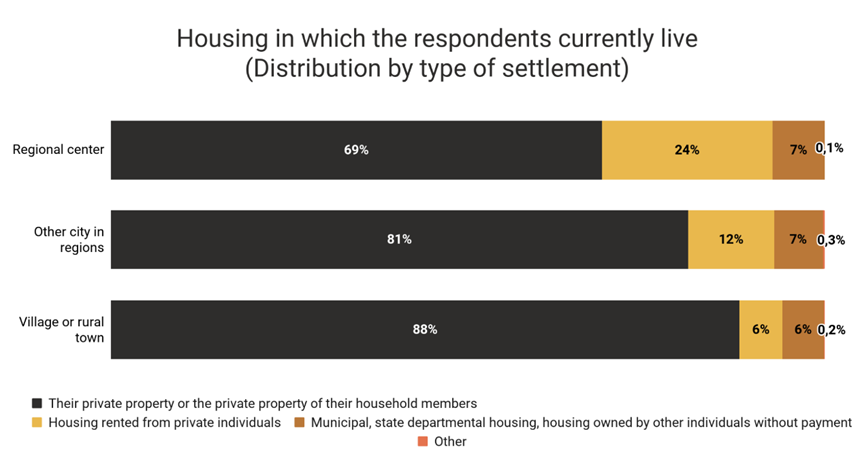

There are differences in the structure of housing ownership across various types of settlements. For instance, the share of people living in owned housing is the highest in villages and rural towns (88% compared to 69% in regional centers and 81% in other cities), while renting is most common among residents of regional centers (24% compared to 12% in other cities and 6% in villages and rural towns). Compared to 2021, the prevalence of renting has increased most significantly in large cities (in 2021, 8% of residents in cities with populations of 100,000 or more rented housing, whereas in 2024, according to Cedos data, 24% of residents in regional centers are renting).

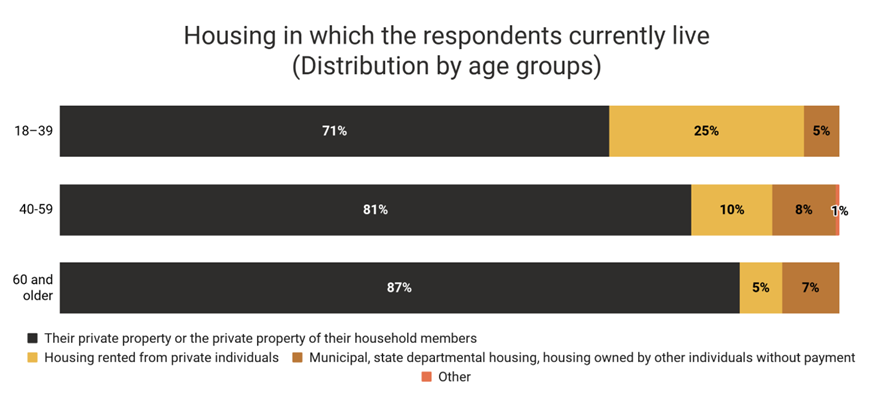

There are certain differences in the types of housing in which people of different ages live. A larger share of elderly respondents live in owned housing compared to middle-aged and younger people (87% compared to 81% among respondents aged 40–59 and 71% among respondents aged 18–39). Accordingly, a larger share of young people live in rented housing — 25% compared to 10% among middle-aged individuals and 5% among the elderly.

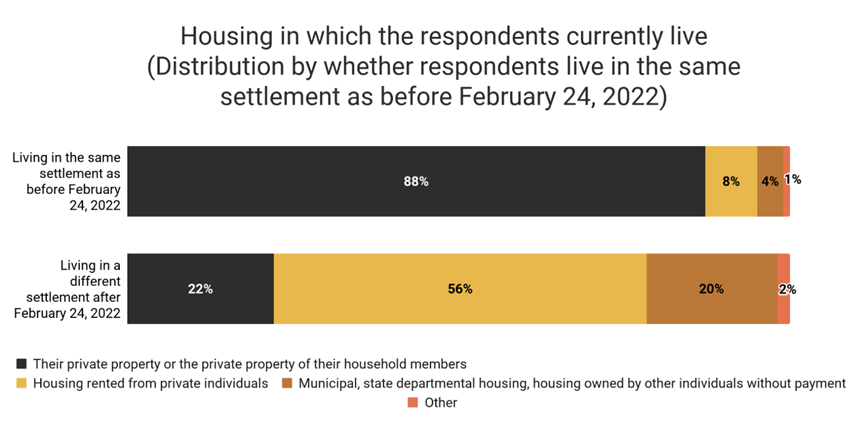

The form of housing ownership differs between people who live in the same settlement where they resided before February 24, 2022, and those who relocated to another settlement. Among the first group, the vast majority — 88% — live in owned housing, while among the second group, more than half live in rented housing, while 20% live in other types of housing, such as municipal, state, departmental, or with private individuals without payment.

Housing affordability

We asked respondents to estimate the average percentage of their household’s total monthly income that is spent on housing. According to one of the most common indicators of housing affordability, housing can be considered unaffordable if a household spends more than 30% of its income on it. Based on this indicator, a total of 42% of Ukrainian households struggle to pay for their housing: 29% spend 31%–50% of their income on housing, and 13% spend more than half of their income.

In the 2022 Cedos study, among respondents who were able to answer a similar question, 52% spent up to 30% of their household’s monthly income on housing, 29% spent 31%–50%, and 19% spent more than half of their household income.

Households of respondents with a low level of material well-being are more likely to spend a large percentage of their monthly income on housing compared to households of respondents with a high level of material well-being.

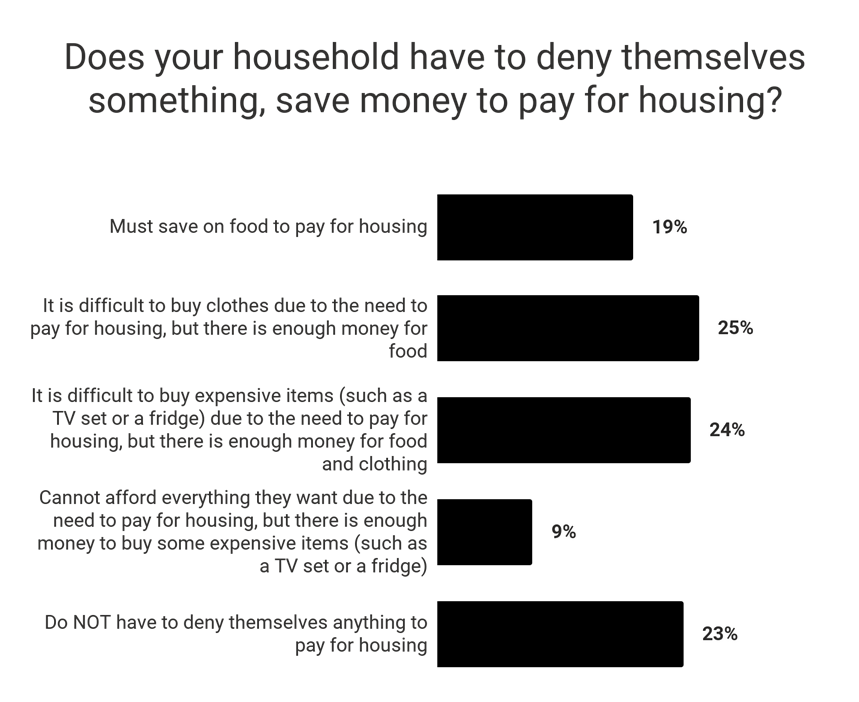

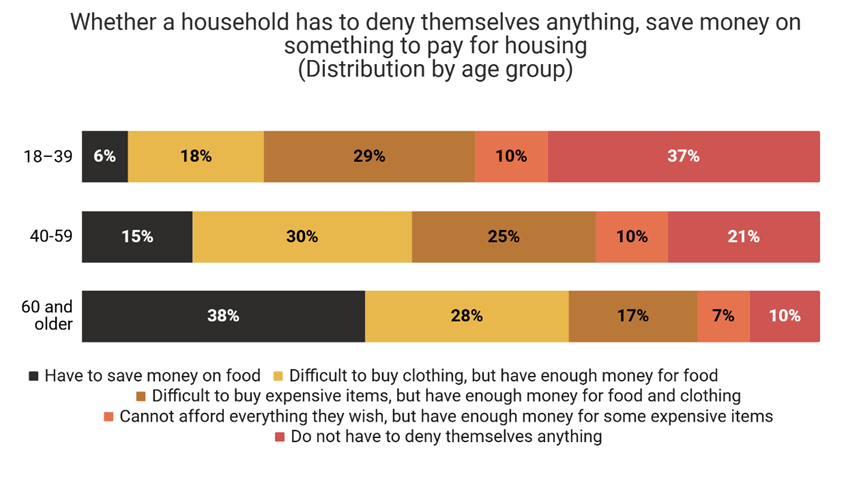

We asked respondents to evaluate whether their household has to economize to pay for housing. In total, nearly half of the respondents save either on food (19%) or on clothing (24%). 23% of respondents did not have to deny themselves anything to pay for housing.

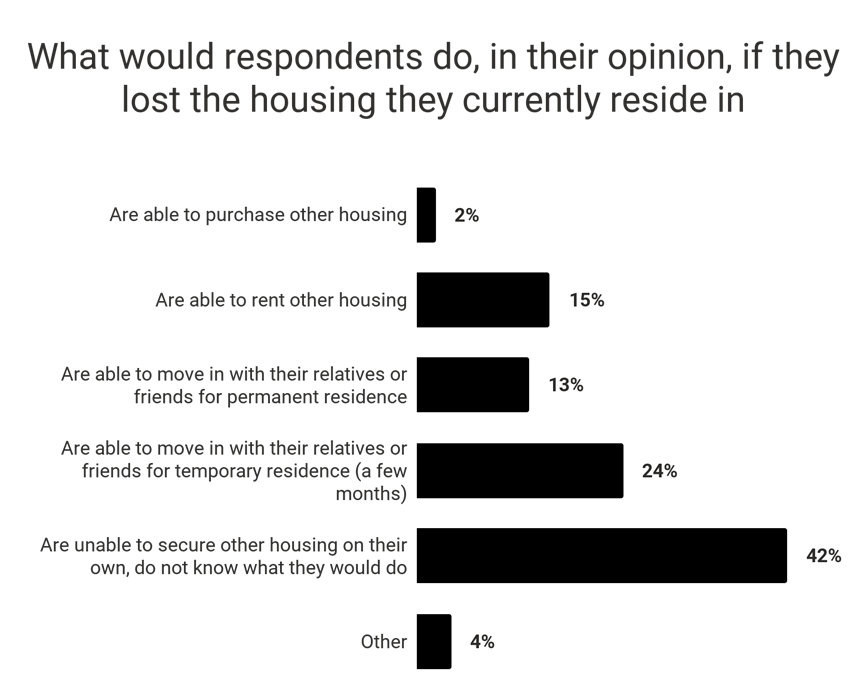

We also asked respondents to share their thoughts on what they would do if they lost the housing they currently live in. The most common response was that they would not be able to secure other housing on their own and did not know what they would do in such a case (42%). Only 2% of respondents indicated they could afford to buy another home, and 15% said they would be able to rent another place.

Differences in housing affordability among people of various ages

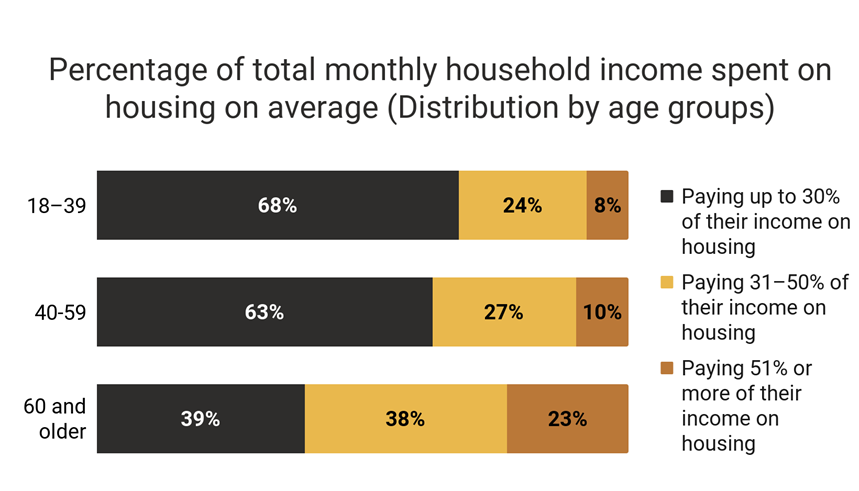

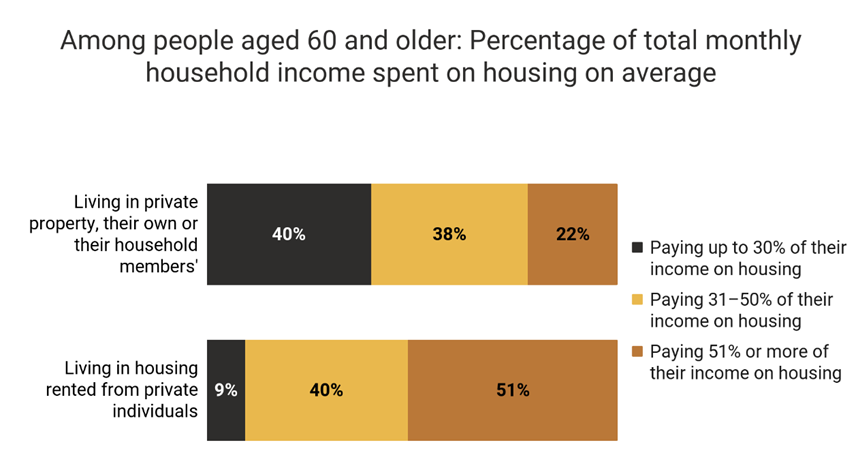

There are differences among people of different ages in the percentage of income they spend on housing on average. Over 60% of households of young and middle-aged individuals spend up to a third of their income on housing, while only 39% of households of elderly people have expenses of this size.

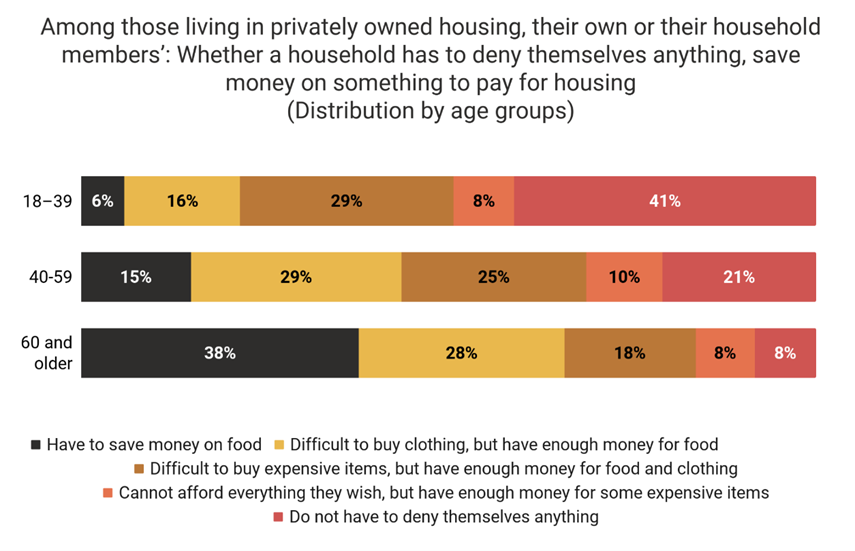

Households of elderly people are more likely to economize to pay for housing: 38% of these households save on food to cover housing costs. Meanwhile, among middle-aged respondents, 15% save on food to pay for housing, and among young people, this figure is 6%.

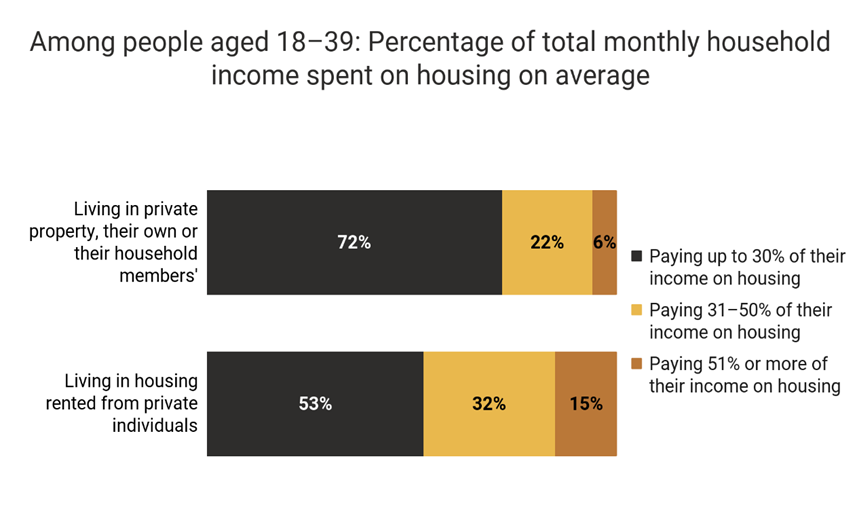

Among people of the same age group living in owned or rented housing, there is a difference in their ability to pay for housing. For individuals aged 18–39, 72% of homeowners spend up to 30% of their household income on housing, compared to 53% of renters.

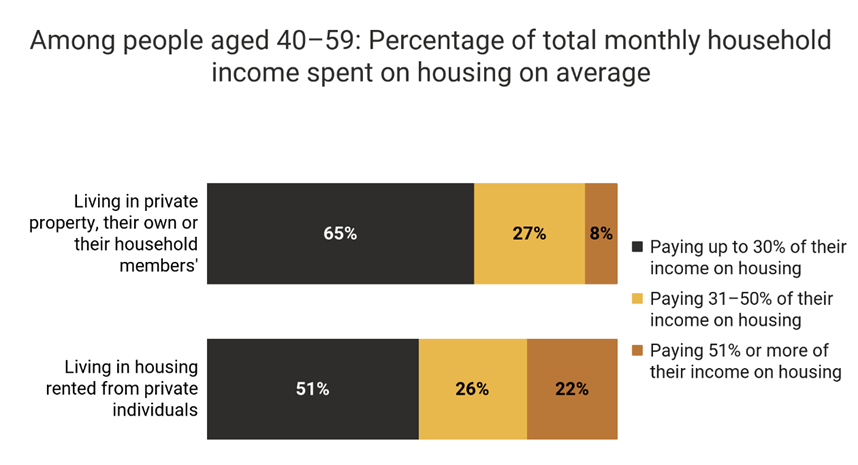

The trend where homeowners spend less on housing than renters persists among individuals aged 40–59: 65% of homeowners spend up to 30% of their household income on housing, compared to 51% of renters.

Homeowners also spend less on housing than renters among individuals over 60 years old: 40% of homeowners spend less than 30% of their household income on housing, compared to 9% of renters.

Among respondents living in owned housing, older people are more likely than others to need to save money to pay for housing. A certain need to economize in order to pay for housing was reported by 59% of households of people aged 18–39, 79% of those aged 40–59, and 92% of those aged 60 and older.

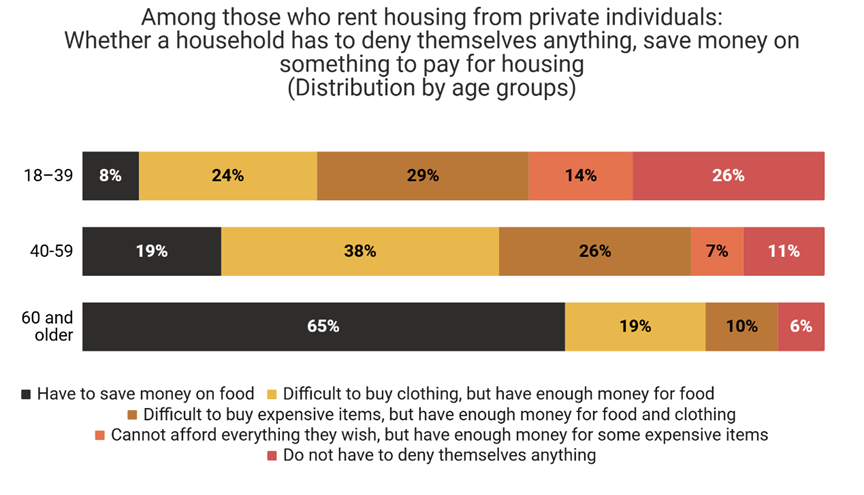

Among renters, the need to save money to pay for housing is also more common for elderly respondents. Two-thirds of households with elderly renters need to save money to pay for housing, compared to 19% of respondents aged 40–59 and 8% of those aged 18–39.

Conclusions

The study findings show that most Ukrainians live in housing owned by their household, although living in rented housing is also common. Between 2021 and 2024, following the start of the full-scale war, the structure of housing ownership changed somewhat. Compared to 2021, the share of people living in owned housing decreased, while more people began living in rented housing.

The form of housing ownership among respondents varies slightly depending on their age, type of settlement, and experience of moving to another settlement. Living in owned housing is most common among residents of villages/towns and elderly individuals, while living in rented housing is more prevalent among residents of regional centers and young people. The vast majority of respondents who continue to live in the same settlement as before February 24, 2024, live in owned housing, whereas those who moved to other settlements after February 24, 2024, mostly rent housing.

Paying for housing is problematic for approximately 40% of respondents: 42% spend more than 30% of their household income on housing, and 44% stated that they are forced to save money on food or clothing to pay for housing. In the event of losing the housing they currently live in, 42% of respondents would be unable to secure other housing on their own and do not know what they would do in this case.

Paying for housing causes more difficulties for people who rent than for those who live in owned housing. Renters in every age group are more likely than those living in their household’s own housing to spend more than 30% of their income on housing.

Housing is less affordable for elderly individuals. Respondents aged 60 and older are more likely than young and middle-aged people to spend more than 30% of their income on housing and are also more often forced to save money on food to pay for housing. On average, housing is most affordable for people aged 18–39. Among them, compared to older people, the smallest shares save money on food to pay for housing (6%) or spend more than 30% of their income on housing (32%). Greater housing affordability among younger people is observed both among respondents living in owned housing and those renting.

Support Cedos

During the war in Ukraine, we collect and analyse data on its impact on Ukrainian society, especially housing, education, social protection, and migration